To read this update in its original PDF format please click here

Memo to: MCJ Capital Partners

From: M. Carter Johnson

Re: Q2 2021 Performance Update

Date: 7/15/2021

Dear Partners & Friends,

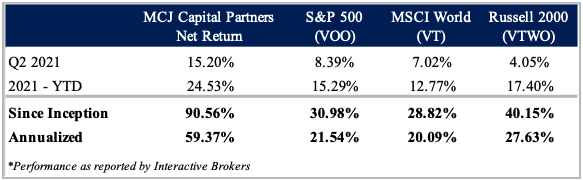

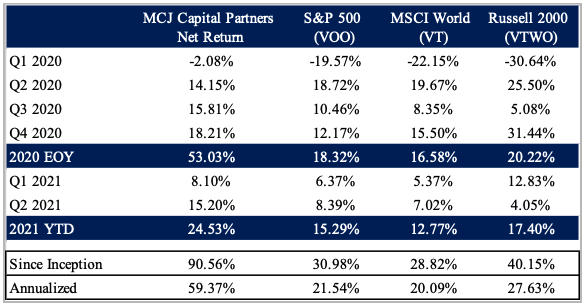

For Q2 of 2021 our total return was +15.20% compared to +8.39% for the broader S&P Index, +7.02% for the MSCI World index, and +4.05% for the Russell 2000.(1)

Since inception (as marked February 12, 2020), our total return is +90.56% compared to +30.98% for the broader S&P Index, +28.82% for the MSCI World index, and +40.15% for the Russell 2000.

Thoughts & Commentary on Q2 2021

There seems to be a lot of chatter around asset bubbles, specifically in U.S. markets. I would say the considerations are warranted. U.S. markets are flirting with valuation levels unseen since the dotcom bubble. Money is cheap and speculative behavior is still running hot. At these levels, mean reverting valuations on U.S. equities imply breakeven forward returns over the next decade. Treasuries and fixed income don’t look much better. If you’re looking for solace in commodities or precious metals, you won’t get much relief as these areas seem to be the go to solution for institutions cooling on the idea of alt coins. Private market valuations are just as lofty with the added caveat of having surplus dry powder running up low quality assets. And depending on your views of inflation, holding cash in hopes of catching a pullback isn’t the easiest idea to swallow these days. So the question is, what’s an investor to do?

I’d argue there’s never been a better time to be a bottom up investor. Focusing on getting to know a company forces you to pay attention to the prospects of the business in relation to its valuation. Doing this you’ll naturally stumble across assets in lands a bit more affordable. For example, if you take a look at our portfolio you’ll find our equity weightings as 34.28% in the U.S., 22.79% in Canada, 21.38% in the UK, 8.86% in Australia, 7.50% in Sweden, and 5.19% in Germany.

If you believe U.S. markets are expensive based off valuation metrics such as the Shiller CAPE, you’ll at least acknowledge markets abroad are a bit more reasonable on a relative basis. And yet our exposure in more reasonably priced markets are by no intentional design of our own doing. We just went to work finding good opportunities that we believe are largely mispriced and as a result found ourselves in less expensive areas of the world.

If we are in a bubble it sure feels like we missed a lot of fun on the way up. We’ve managed to generate our returns owning run of the mill businesses such as drive through safari parks, niche rail terminals and other assets that fail to generate the exciting buzz that’s occupied headlines over the last two years. Sure we hold a few phenomenal software and technology focused companies, but even those positions seem a little too ordinary to garner the coveted status of a meme stock.

It’s important to remember that in stretches of time when markets perform well, valuations do still matter. What could happen to the downside is just as important as what could continue on the upside. We can’t just play offense, defense is equally important in our game. Bubble or not, inevitably markets will go through sell offs. When they do, it will be uncomfortable. During those times our best defense against possibilities of permanent capital impairment is to own quality companies largely ignored by the speculating crowds.

Commentary on Our Companies

Speaking of quality companies, let’s spend a moment on one of our holdings, but first a little history...

In 1870 the share of American households with indoor plumbing was close to 0%. Bathing, washing, cleaning, cooking, and laundry required the need to manually carry clean water in, and dirty water out. Households depended on chamber pots and open windows into backyards to dispose of waste. It wasn’t until 1875 that the first plumber-type water closet was created and even then, the water was drained into sitting cesspools. The lack of adequate sanitary disposal created a boom in waterborne diseases such as cholera and typhoid fever. The problem for households was even with plumbing fixtures (which roughly a third had), there was no network of piping from municipal waterworks to connect to. Spurred by a public health initiative and concern over waterborne illnesses, the government went to work expanding the piping network of the country. From 1870 to 1924, the count of municipal waterworks boomed from 244 to 9,850. With piping and municipal waterworks in place, homes across the country could integrate into the network. By 1920, the number of households with private toilets in households was close to 20%. By 1930 the number of households with private toilets vaulted to 50%. The boom in plumbing was driving down cholera and typhoid fever and simultaneously giving birth to new commerce opportunities.

It was about this time (1924 to be exact) a man by the name of Samuel Oscar Blanc came across a problem with all this new piping. Blanc’s son Milton Blanc, lived in an apartment that had a clogged drain due to tree roots invading the underground pipes. Convinced there was a better way to fix the problem other than digging up the entire piping, Blanc went to work creating a machine that could solve the problem above ground. Fastening a steel cable to a Maytag motor, Blanc created the first heavy duty “Plumber’s Snake.” The machine worked and just in time to meet the demand of similar problems as the network of piping spread fast across the nation. Blanc incorporated a business around the patented machine, calling it “Roto-Rooter.” The model was simple. For $250 you could buy Blanc’s machine and start your own Roto-Rooter business in your local area. The timing was on point not just for piping but also for entrepreneurial endeavors. After the Great Depression wreaked havoc on employment opportunities, many individuals were eager and willing to start their own source of income. The Roto-Rooter franchise concept took hold spreading fast in the Midwest and Northeast, all to solve those pesky problems of clogged piping.

Today Roto-Rooter has close to 500 franchise territories, servicing over 90% of the U.S. population. In addition, the company has master independent franchise operations in Mexico, Philippines, Japan, United Kingdom, China, and Singapore. Franchise owners benefit not only from a proven business model but also superior brand recognition and a backend infrastructure that outcompetes most operations in the highly fragmented localized end markets. The company maintains an estimated 15% of the overall drain cleaning market and 2-3% of same-day plumbing service calls.

The Roto-Rooter company is owned by Chemed Corporation. In addition to Roto-Rooter, Chemed owns Vitas, a hospice provider with 49 programs across the nation. We own Chemed, which means we own Roto-Rooter and Vitas.

Looking over our portfolio, Chemed’s been one of our “laggards” this year, underperforming both the index and our other companies when strictly assessing the market price of securities. While it’s fun for me to boast about our highflyers, I find it more useful to explain why we own certain companies, especially when they underperform.

What makes Chemed so appealing is underneath the essential businesses of plumbing and hospice care, is a dialed in process for redistributing cash flow in a manner that grows earnings. Plumbing and hospice care are slow growth businesses, mostly tracking population trends in their given operating markets. The cash flow produced from these operations well exceeds the reinvestment needs to maintain growth at the operational level. Excess cash flow gives Chemed the option to pay down debt, buy back shares, issue dividends, or expand the operational footprint by reacquiring Roto-Rooter territories or new hospice programs. To understand how Chemed utilizes these levers let’s take a look at activity over the last 10 years.

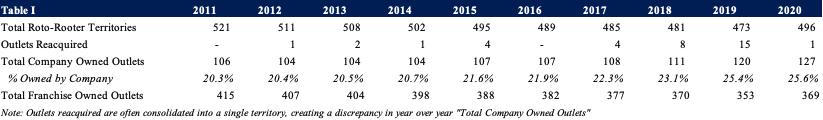

Looking at the table below, we can see can see Chemed has reacquired 36 Roto-Rooter franchise territories over the span of 10 years.

This has brought the collective company owned territories from 106 ( 20.3% of total territories) to 127 (25.6% of total territories). Objectively, acquiring another company isn’t special in itself. However, Chemed’s position as the buyer of Roto-Rooter franchises gives them a distinct irreplicable advantage of being not only just a buyer but also the franchisor. As the franchisor, Chemed knows the seller (franchisee), and has the internal data to analyze precisely how the specific territory has evolved and performed over the years compared to other Roto-Rooter territories. This means Chemed can swing at acquisitions with a lower probability of overpaying or having the acquisition totally flop. Reacquiring territories gives Chemed a great outlet for reinvesting cash flow. How long can Chemed keep this gambit up? As of March 31, 2021, Roto-Rooter had 369 territories still owned by franchisee’s. Should Chemed just maintain its current 10 year average of Roto-Rooter acquisitions, it would hypothetically take over 90 years to bring the entire Roto-Rooter operation under Chemed company ownership. The runway to deploy capital through Roto-Rooter acquisitions is long and Chemed simply has to wait patiently as territory owners retire.

Opportunities with Vitas are equally promising. Looking at Table II, we can see Chemed’s total Vitas program count has advanced at a slower clip than the Roto-Rooter acquisition front, but the business has had solid organic growth.

Average daily census count per location has swelled from 305 in 2011 to 389 in 2020. In addition, you’ll notice steady growth of independent hospice programs over the same period. The fragmented nature of the industry gives Chemed a nice runway to grow both organically and through acquisitions well into the future.

When the levers for acquisition aren’t available, Chemed has done a good job returning capital to shareholders in the form of buybacks and dividends.

Years where acquisition opportunities were low, the company reacquired shares and returned capital to shareholders in the form of dividends. Years where acquisition opportunities existed, the company made use of capital to grow the underlying businesses.

On May 18, 2021 Chemed’s board authorized $300 million for share buybacks. Chemed will keep doing what it has done; buyback shares, issue dividends, reacquire Roto-Rooter franchises, expand Vitas. It’s a good company that will keep chugging along. When the marketable securities of our companies “underperform” it’s important to remember what they really are – ownership stakes in businesses.

Final Thoughts

Transitory or persistent? The conversation around inflation seems to consistently grip headlines with convincing arguments in both directions. What’s interesting about inflation is how self-fulfilling it can become. What starts as transitory inflation could very easily evolve into persistent inflation. I think the most telling indicator will be wage growth post expiration of unemployment benefits. Labor markets are beyond tight, with many employers offering signing bonuses and high entry level pay for new employees. While signing bonuses will likely eventually fade, new employee pay levels are more permanent to the cost structure. Will it be sustained after unemployment runs out in the fall? And will it be enough to offset long term deflationary trends within business operations? Time will tell. As for how inflation impacts our companies, we completed an analysis of how our portfolio of companies would perform under various scenarios. Overall, the results were pretty much a net wash with some businesses continuing to benefit in a deflationary environment and some that would benefit from a more persistent inflationary environment. Overall, I like that. As a reminder, macro isn’t our game, and this was more just an interesting thought exercise.

As the summer heats up I hope you are enjoying it as much as I am compared to last year. It’s nice to have local farmers markets open, pools buzzing with smiling people, and the general feel of a real summer. If you find yourself in the Denver, Colorado area reach out, as it’s always nice to grab coffee or lunch. In the meantime, we’ll keep looking for good businesses at fair prices.

All the best,

M. Carter Johnson

The performance results shown are those of the first account under management of MCJ Capital Partners LLC (“MCJ”) and are the result of the application of MCJ’s proprietary investment process. These performance results are presented net of all fees including brokerage, margin, custodial, and a 1% management fee beginning in January 2021. No management fee was charged in 2020, all other fees were present. A client’s return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account, including advisory fees in the future. The performance results include the reinvestment of dividends and interest on cash balances where applicable.

All performance results are unaudited and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. All information provided is for informational purposes only and should not be deemed as advice in relation to legal, taxation, or investment matters. Past performance is not indicative of future results.

Each of the S&P 500 Index, the MSCI Index, and the Russell 2000 Index (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of an account managed by MCJ and each Index may not be comparable. There may be significant differences between an account managed by MCJ and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index. The S&P Index return was determined using the performance of Vanguard S&P 500 ETF (VOO). The MSCI Index return was determined using the performance of Vanguard Total World Stock ETF (VT). The Russell 2000 Index return was determined using the performance of Vanguard Russell 2000 ETF (VTWO).

MCJ offers investment advisory services and is registered with the state of Colorado. Registration does not constitute an endorsement of the advisory firm by the Colorado Securities Commissioner nor does it indicate that the advisory firm has attained a particular level of skill or ability. All content on this webpage is general in nature, not directed or tailored to any particular person, and is for informational purposes only. Neither this webpage nor its contents are offered as investment advice and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. In addition, neither this webpage nor its contents should be construed as legal, tax, or other advice. Individuals are urged to consult with their own tax or legal advisers before entering into any advisory contract.

The information contained herein reflects the current expectations and opinions of MCJ as of the date of publication, which are subject to change without notice at any time. MCJ does not represent that any expectation or opinion will be realized. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Neither MCJ nor any of its advisers, officers, directors, or affiliates represents that the information presented in this tear sheet is accurate, current or complete, and such information is subject to change without notice. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment.

Past performance is not indicative of future results.

Additional information is available from MCJ upon request. MCJ is not acting as your adviser or agent unless and until you and MCJ sign an investment advisory agreement.

Readers are advised that the material herein should be used solely for educational purposes. This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. MCJ Capital Partners LLC does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. MCJ Capital Partners LLC will not be liable for any loss or damage caused by a reader's reliance on information obtained in any of our newsletters, presentations, memorandums, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions.

MCJ Capital Partners and accounts actively managed by MCJ Capital Partners have a long position in Chemed Incorporated (CHE) and would benefit from overall price appreciation of the stock. At any time we may close the position without notice.