To read this update in its original PDF format please click here

Memo to: MCJ Capital Partners

From: M. Carter Johnson

Re: Q2 2023 Update

Date: 7/31/2023

Dear Partners & Friends,

For Q2 of 2023 our total return was 8.03% compared to 8.30% for the broader S&P Index, 5.31% for the MSCI World index, and 4.91% for the Russell 2000 index.[1]

Since inception (as marked February 12, 2020), our total return is 60.66% compared to 35.56% for the broader S&P Index, 20.58% for the MSCI World index, and 14.49% for the Russell 2000 index.

[1] Please see reference one (1) for full breakdown of performance and benchmarks

Thoughts and Commentary on Q2 2023

In Jonathan Swift’s 1726 classic, “Gulliver’s Travels,” Gulliver is swept away to a place called Brobdingnag. As Gulliver discovers, the land of Brobdingnag is occupied by giants 12 times his size. We’re certainly not in Brobdingnag, but we do find ourselves in a land dominated by giants. The first half of the year shaped up with an impressive performance from the S&P 500, however, it was the effort of the five largest mega-caps that drove the freight of returns for the index. On the heels of excitement surrounding innovations within Artificial Intelligence, Apple, Microsoft, Alphabet, Amazon, and Nvidia, powered the index up 15.92% through June of 2023. According to Bloomberg Finance, these top five giants are contributing more to index returns than any other year over the last two decades. To find a comparable period you would need to go back to the dotcom bubble of the late 90’s and then the Nifty Fifty era of the 70’s prior to that.

These giants aren’t just powering returns, they also are making passive index investing a much more concentrated strategy. The top ten mega-caps currently make up around 32% of the total index capitalization. This translates to roughly 60% higher than their historical average of 20%. Even more astounding, the individual market capitalization of Apple now stands at around $3 trillion, dwarfing the entire $2.7 trillion market cap of the Russell 2000 index.

How does this compare to our portfolio? Unlike Gulliver’s giants who were simply 12 times his size, our giants of comparison are “slightly” bigger. The median market cap of our portfolio stands at $172 million. That makes Apple a towering 17,411 times larger than the median size company of our portfolio (a number I had to calculate three times to believe). To catch up in size, our median company would need to compound nearly 22% annually for half a century (yes, 50 years) to reach Apple’s current market capitalization.

The Aggregation of Marginal Gains

The giants are dancing and the crowds are growing ever more excited about what a world looks like with AI. However, during these bursts of hyper innovation what we so easily forget is advancement isn’t merely about grand gestures and bold leaps; it’s also about the value of tiny, consistent steps, each one adding up, compounding over time. One of the more infamous examples of the power in marginal gains is the story of small improvements made by British Cycling Coach David Brailsford. If you’re unfamiliar with Coach Brailsford and the transformation of British Cycling, I’d encourage you to read a phenomenal account of what happened written by James Clear which you can find here.

The aggregation of marginal gains and hyper innovation are not mutually exclusive. However, within an investing context the former provides a few advantages over the later. For starters, marginal gains have more stability and durability over time spans. Marginal gains also allow for iterative learning and positive feedback loops within businesses. Even more appealing for us investors, is the effect of marginal gains and how they compound over time. In addition, marginal gains are practical and accessible at all levels of an organization, making “wins” accessible for all who date to look for them.

Let’s take a further look on how hyper innovation and marginal gains compare and show up in our businesses...

1) Stable and Durable – Hyper innovation relies on singular revolutionary ideas. While exciting, these breakthroughs create volatility, even for organizations that champion the innovation as the originators. In contrast, an organization built on marginal gains harvest advancements from multiple areas of effort, creating a more robust foundation less dependent on singular ideas for progress. The marginal gains approach leaves the organization subjected to less volatility within the overall business. An organization championing marginal gains isn’t static, its consistent. And within the consistency the durability of the business model chugs along. Consider our company Lifco (LIFCO.B.SFB) who champions continuous incremental improvements as a driving force for the organization. Earlier this year CEO Per Waldemarson commented:

“If we go further into the numbers, we also have even stronger growth in our EBITA profits, which basically means that our margins are improving, up to 22.3% in the quarter, which has to do with a few factors. Obviously our continuous improvements in our companies continues to go very well. We always strive for improving our margins and being more differentiated and strong in our niches.”

Mr. Waldemarson uses the word “obviously” as if continuous improvement is a cultural given for all organizations. It’s not. Over the years, Lifco’s focus on continuous improvement has fueled advancement to the underlying business while simultaneously strengthening the collective durability of the organization. It is a cultural component embedded in the business and championed by its people.

2) Iterative Learning and Positive Feedback Loops – Hyper innovation focuses on singular leaps that can bypass crucial learning and limit potential refinement. In contrast, marginal gains thrive on iterations of learning and methodical positive feedback loops. Consider the power of how Constellation Software (CSU.TO) goes about disseminating best practices across its diverse base of business units, per Jeff Bender, CEO of Harris Operating Group:

“So again, the leaders from the business that we believe are executing and delivering on the best practice, then share that with all of the other attenders from all the other...So you have hundreds and across Constellation, thousands of employees are taking in these best practice sharing sessions. And then at Harris, and I think some of the other groups have similar systems, we have what we call the Harris Hub, which is sort of I think of it as a SharePoint like site that is organized and basically brings all of this content together in videos and articles and artifacts that any employee can go and access.”

Thousands of employees sharing crucial learning feedback loops by disseminating small pieces of best practices. Together this effort fuels an aggregate of marginal gains for the company.

3) Cumulative Effect That Compounds – Hyper innovation has the result of immediate breakthroughs. These breakthroughs are sporadic (and more or less random), which by nature is what makes them so exciting. They also plateau until the next breakthrough occurs. Marginal gains on the other hand have a more consistent cumulative effect that compounds. If you study our business Copart (CPRT), you’ll notice the relentless consistency over the years of the how the company increases throughput. Copart has never shied away from innovation, but it’s usually the type innovation that focuses on scaling incremental marginal gains within a subset of the business model. A recent example of this is a comment CEO Jeffrey Liaw stated earlier this year regarding vehicle processing:

“Our clients also expressed strong interest engaging with our image recognition tools and machine learning algorithms to enable better decision-making and importantly, faster decision-making.”

Incremental gains like these add up when you’re shaving off a few minutes of decision making for over 3 million cars a year.

4) Practical and Accessible – Finally and perhaps most powerful is how practical and accessible the aggregation of marginal gains is versus relying on hyper innovation. By focusing on small, achievable improvements, the barriers to entry are significantly lowered, allowing more people to contribute to overall progress. Business history is filled with infamous stories like the one of an American Airlines flight attendant who noticed passengers weren’t eating their olives. When removed from the salads, the company saved $40,000 a year. Or the Amazon employee who figured out how removing lightbulbs from vending machines would save the company $20,000 annually. My favorite example was the measures taken by Old Dominion Freight Line to combat high fuel cost leading into the 1980’s. The company focused on small achievable improvements such as reducing tire pressure, teaching drivers upshifting techniques, and installing equipment such as clutch fans, air shields and fuel squeeze engines. Collectively the aggregate improvements saved the company $260,000 for every one-quarter mile gain in fuel efficiency across their fleet.

Marginals gains don’t make headlines. And in periods where markets are running based on exciting innovation it’s easy to feel left out of the dance. However, in our investment process, we will continue to prioritize champions who seek incremental marginal gains to keep the engine humming. It’s not always easy to find these types of businesses but when we do, they’re worth holding onto for the long run.

As it Relates to MCJ Capital Partners

Marginal gains aren’t limited to just the businesses we invest in. They can and should be a goal of our own processes. One area I’ve aimed to improve is the system for compiling and housing our research notes. As you may or may not know, a qualitative investment process requires a lot of note taking. In traditional note taking systems, research notes are typically organized by a predefined hierarchy order. The problem is, as more notes go into the system, the value of any individual note decreases, as recall of available insights are limited to memory of the notes existence or an overly organized index to navigate through the entire system. Some systems allow for keyword search and tags to allow for better recall but it still limits the system to a more silo structured thinking.

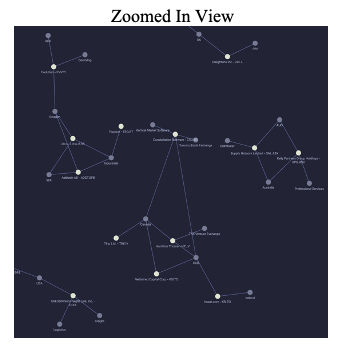

This past quarter I upgraded to a non-linear note system to host MCJ Capital Partners research. It has all the bells and whistles of its linear counterpart (hierarchies, folders, tags, keyword search, etc.), with the added and most valuable component of being able to inner connect notes and locate visual relationships and themes. With this new system, each note grows incrementally more valuable, as it has the functionality to serve as a connection node to past (and future) research. Unlike a linear system that eventually buckles under its own weight, this new system fosters incremental marginal gains making our analysis and insight that much better. What I like most, is that it also takes a proprietary form of how we view the world and the relationships between companies, industries, and mental models. Ultimately, it’s skeletal structure will always be unique to our process and analysis. I have hopes that over time, this will further improve our analytical advantage. Through two and a half months, 174 notes have been compiled, and clusters of connection nodes have already begun to form. You can see the result below:

In Closing

We haven’t been too active this year in regards to trades, but that doesn’t mean we’re simply inactive altogether. We’re up to the usual of looking at new businesses, keeping tabs on older targets, staying on top of our current businesses and patiently waiting for something that warrants deploying capital. In essence, we’re just focusing on the process. Hope you’re having a good summer wherever this letter finds you.

Until next time,

M. Carter Johnson

1) The performance results shown are those of the first account under management of MCJ Capital Partners LLC (“MCJ”) and are the result of the application of MCJ’s proprietary investment process. These performance results are presented net of all fees including brokerage, margin, custodial, and a 1% annual management fee beginning in January 2021. No management fee was charged in 2020, all other fees were present. A client’s return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account, including advisory fees in the future. The performance results include the reinvestment of dividends and interest on cash balances where applicable.

All performance results are unaudited and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. All information provided is for informational purposes only and should not be deemed as advice in relation to legal, taxation, or investment matters. Past performance is not indicative of future results.

Each of the S&P 500 Index, the MSCI Index, and the Russell 2000 Index (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of an account managed by MCJ and each Index may not be comparable. There may be significant differences between an account managed by MCJ and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index. The S&P Index return was determined using the performance of Vanguard S&P 500 ETF (VOO). The MSCI Index return was determined using the performance of Vanguard Total World Stock ETF (VT). The Russell 2000 Index return was determined using the performance of Vanguard Russell 2000 ETF (VTWO). All data for VOO, VT and VTWO are derived from Yahoo Finance Historical Data.

MCJ offers investment advisory services and is registered with the state of Colorado. Registration does not constitute an endorsement of the advisory firm by the Colorado Securities Commissioner nor does it indicate that the advisory firm has attained a particular level of skill or ability. All content on this webpage is general in nature, not directed or tailored to any particular person, and is for informational purposes only. Neither this webpage nor its contents are offered as investment advice and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. In addition, neither this webpage nor its contents should be construed as legal, tax, or other advice. Individuals are urged to consult with their own tax or legal advisers before entering into any advisory contract.

The information contained herein reflects the current expectations and opinions of MCJ as of the date of publication, which are subject to change without notice at any time. MCJ does not represent that any expectation or opinion will be realized. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Neither MCJ nor any of its advisers, officers, directors, or affiliates represents that the information presented in this tear sheet is accurate, current or complete, and such information is subject to change without notice. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment.

Past performance is not indicative of future results.

Additional information is available from MCJ upon request. MCJ is not acting as your adviser or agent unless and until you and MCJ sign an investment advisory agreement.

Readers are advised that the material herein should be used solely for educational purposes. This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. MCJ Capital Partners LLC does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. MCJ Capital Partners LLC will not be liable for any loss or damage caused by a reader's reliance on information obtained in any of our newsletters, presentations, memorandums, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions.

MCJ Capital Partners and accounts actively managed by MCJ Capital Partners have long positions in Lifco (LIFCO.B.SFB), Constellation Software (CSU.TO) and Copart (CPRT) and would benefit from overall price appreciation of the stocks. At any time we may close these positions without notice.