To read this update in its original PDF format please click here

Memo to: MCJ Capital Partners

From: M. Carter Johnson

Re: Q4 & 2021 End of Year Update

Date: 1/31/2022

Dear Partners & Friends,

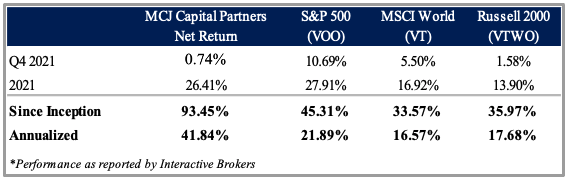

For Q4 of 2021 our total return was +0.74% compared to +10.69% for the broader S&P Index, +5.50% for the MSCI World index, and +1.58% for the Russell 2000 index.[1]

For 2021, our total return was +26.41% compared to +27.91% for the broader S&P Index, +16.92% for the MSCI World Index, and +13.90% for the Russell 2000 index.

Since inception (as marked February 12, 2020), our total return is +93.45% compared to +45.31% for the broader S&P Index, +33.57% for the MSCI World index, and +35.97% for the Russell 2000 index.

Thoughts and Commentary on 2021

The second half of 2021 could almost be described as the bear market that wasn’t. While the major indices chugged along, beneath the service was a strong riptide pulling down almost everything but large companies. From an asset rotation perspective the move into larger index leading companies was logical. Generally, when the market senses danger, capital flees to safety. However the riddle at this point in time was where does capital go when the “safest” assets were already underwater?

If we visualize a traditional risk reward chart we can see the conundrum capital faced beginning in late June. If inflation is around 6%, holding cash means accepting a 6% haircut. Typically treasuries give the closest “risk-free” return, yet with sub 2% yields, inflation equates to accepting negative real returns (note, Treasury Inflation-Protected Securities “TIPS” also are yielding negative real returns). As we move up the risk ladder we can see larger more predictable companies appeared to offer a better ante to park capital in hopes of treading water. This rotation kept indices moving higher while drastic selloffs happened under the surface. The biggest casualties came from growth heavy pandemic favorites. Towards the end of the year roughly 40% of Nasdaq companies were down more than 50% from their 52-week highs. As I prep this memo for release most indices have now rolled over and are in or flirting with correction territory.

As I’ve mentioned before and will mention again, our concern is not with price fluctuations of our companies marketable securities, but the fundamentals driving their intrinsic value. For this reason I welcome (and encourage you to as well) volatility as it gives us an opportunity to add to our best ideas in addition to upgrading our portfolio with higher quality companies that were previously priced out of reach. Volatility is a risk to those who need liquidity in the short term. It is an opportunity for those with long time horizons.

Commentary on Our Companies

Our top contributor to overall performance in 2021 was RediShred Capital Corp (KUT.V). RediShred operates in the on-site document destruction industry serving small and medium sized businesses in over 30 locations and 40 markets. The company has done well, rebounding from headwinds created by the Pandemic. Initially entering our position in the summer of 2020, we were attracted to RediShred based on industry dynamics, the operating structure and the underlying growth engine of the business. Let’s take a look at each of these in a little more detail...

Industry Dynamics - The document destruction industry generates little headline excitement in the investing world. Yes, overall paper usage is declining and that in itself deters many investors from exploring opportunities in this space. However, the rise of information theft prevention and overall trends in recycling have contributed to positive and consistent demand growth for on-site certified document destruction. Meeting this demand is a fragmented industry with operators dependent on geographical proximity to their customer base. There are a few large players such as Cintas, Shredit and Iron Mountain but they primarily compete for larger customers with off-site document retainment and destruction needs. The bulk of on-site document destruction for SME’s is carried out by independent operators with two trucks or less, and little to no backend support systems.

Customers who use on-site document destruction are typically privy to client sensitive data and can be subject to fines and litigation in the event of an information breach. To meet compliance and regulatory protocols these end customers hire companies like RediShred to drive to their office, pick up secured bins with paper that needs shredding, have the shredding completed on-site, and are then given a certificate documenting the destruction of the documents. The service itself is often recurring (typically scheduled either on a monthly or quarterly basis), low cost, and in many cases essential to customer operations. The customer base is highly fragmented with medical, financial, accounting, legal and other data retention sensitive type firms generating demand for services.

For operators in on-site document destruction, profitability is primarily driven through route density, meaning that adding customers to routes offers the greatest return on assets. A truck zig-zagging across town to different customers is less efficient and incurs higher variable cost on service fulfilment. A truck with an optimized route and a higher concentration of customers at a single location (such as an entire office building) generates a higher return on assets and lower variable cost in the operating structure.

Overall the industry is rather mature with most geographic markets having some established operator in the area. Operators looking to expand into new territories are faced with the dilemma of stealing market share from entrenched incumbents with operating cost advantages from an established route base. Even if the operator can swipe a handful of customers to get the route going, it needs to be enough to justify an adequate return on the capital investment (new trucks) above supporting the new operating cost (with both fixed and variable components). At the end of the day, growing operators who can integrate and support back office functions are better off acquiring incumbents. This has led and will continue to lead to consolidation of the industry.

Operating Structure – Rooted within the industry RediShred has an ideal operating structure that positions the company well amongst competition. RediShred actually is a franchise platform that owns and operates three brands; PROSHRED, PROSCAN and Secure e-Cycle. A franchise platform has allowed RediShred to build out a national footprint without having to deploy capital in unproven, competitive markets. Franchisees buy the trucks, recruit and train staff, build up local routes and complete day to day operations all while paying RediShred a royalty fee. The franchisees benefit from having best practices, back office support systems, sales and marketing, along with routing technology less available to smaller independent operators. As franchisees near retirement, RediShred is first in line to scoop up the proven territory and transition it to corporate owned and operated. In fact, just 16 locations are now franchises with the remaining being corporate.

As the company continues to consolidate locations, greater benefits of operating leverage flow through the business. As a percentage of revenue, general and administrative expenses have steadily moved lower from 41% in 2012 to just 12% today. As the industry continues to consolidate, RediShred’s centralized functions within the back office improve its advantage against independent operators.

Growth Engine – For a participant in a slow growing industry, RediShred has quite a few levers to pull to foster growth. These levers award the company advantages in how it grows both organically and acquisitively in relation to its industry peers.

Organically, the company has a back office support and sales infrastructure to proactively improve route density around customer clusters. In 2019, the company put in place route optimization technology to further drive this efficiency. Perhaps most beneficial for organic growth is RediShred’s benefit of having established location hubs that can serve as beachheads to launch into new adjacent markets. CEO Jeffrey Hasham explained this greenfield strategy during an interview in February of last year:

“We greenfield in Western North Carolina and upstate South Carolina because I have a base of operation in Charlotte. So that allows me to start with a low cost. I can send a route once a week, and I can deploy a sales person there to build the route without having a permanent office and all the overhead that goes with it. And then when we get to a certain size we can have more a permanent establishment in a location.” - CEO Jeffrey Hasham Interview February 2021

In a fragmented industry dominated by independent operators, this advantage of sending a PROSHRED truck once a week while simultaneously deploying sales resources is a methodical capital efficient tactic for expanding territories. Independent operators would need to establish a back office infrastructure and improve available route capacity to replicate this type of organic growth in efforts to seize new markets. With most operators having two trucks or less, and no more than three to four employees, this type of growth is out of reach.

Greenfield expansion isn’t the only lever available for RediShred’s organic growth. The on-site document destruction business, PROSHRED, contributes to the majority of company performance. However, RediShred does have two other brands and service offerings in the stable. Secure e-Cycle is an electronic waste collection business based in Kansas City. RediShred is now marketing it throughout the Midwest in what will be a regional service offering. The other brand, PROSCAN, offers scanning and digital archiving of documents in a format that allows indexing and searchable functions. At the start of 2021, PROSCAN was generating a little over one million in sales between just two locations. As this line of business matures at other locations, it’ll both contribute to topline growth and strengthen revenue mix. Together, PROSHRED, Secure e-Cycle and PROSCAN offer strong cross promote opportunities that will continue to grow as customer awareness around the service offerings advance.

Overall organic growth is promising but the real advantages for RediShred reside on the acquisition side of the business expansion. As previously mentioned, RediShred owns a franchise platform. This gives them a distinct advantage of having an almost proprietary like pipeline of acquisition targets. Due to the nature of franchise royalty fees, RediShred benefits from having an inside look at the business while its operated by the franchisee. As the franchise operator nears retirement, RediShred can offer a purchase price backed by more knowledge of the operating conditions and intimate details of the business. Similar circumstances are above the capabilities for other prospective buyers vetting acquisition targets. This puts RediShred at an advantage amongst other onsite document destruction consolidators. Markets occupied by franchisees are platform acquisition opportunities for RediShred corporate to move into new (and now proven by the franchisee) territories. Using the location as a hub, RediShred can then lean on its cost structure and back office infrastructure to further accelerate growth by acquiring independent operators outside of the franchise brand in a typical bolt-on fashion. Since 2010, the company has purchased 14 franchise territories and 5 independent operators, of which 9 acquisitions were completed in the last three years. In a consolidating industry, RediShred has the machine in place to drive growth both organically and through accretive acquisitions.

Proponents against RediShred will echo the rally cry heard over the last five decades that the world is going paperless. They’ll highlight RediShred’s exposure to cyclical recycled paper prices as a vulnerability to bottom line profits. They’ll point to RediShred’s capital structure and need to issue equity as unswallowable deterrents. Overall, every investment has a little hair on it, but we like RediShred and where it’s going. As always, those circumstances can change, and we’ll keep an eye out on factors we’ve identified that would sway our position.

Closing Thoughts

I’ve had a few people ask me my thoughts on interest rates, where they are headed and how high they will go. My answer is simple – I have no idea, and I would be cautious against putting weight into anyone who claims otherwise.

What I do find fascinating is the reflexivity of the system. A Fed that signals a hawkish tone can actually achieve what rate hikes are intended to achieve in the first place. Anticipation of rate hikes curbs spending as decision makers begin to budget higher borrowing cost. Asset prices regress as investors in hot running markets readjust their model discount rates and begin selling and bidding lower on what is perceived as expensive assets in the future rate environment. Thus the act itself of signaling rate hikes and quantitative tightening can achieve the desired effect of slowing an overheated economy. However, a market that has grown accustomed to the Federal Reserve playing rescue to falling asset prices may not pump the breaks at all, thus forcing a hawkish tone to turn into stronger than anticipated hawkish actions. We’ll see what happens...

What’s important to remember is we’re not trying to time interest rates or be dependent on any particular interest rate environment to successfully compound capital. We want to be owners of good businesses with strong components that allow for long term compounding of their intrinsic value.

Until next time,

M. Carter Johnson

1) The performance results shown are those of the first account under management of MCJ Capital Partners LLC (“MCJ”) and are the result of the application of MCJ’s proprietary investment process. These performance results are presented net of all fees including brokerage, margin, custodial, and a 1% management fee beginning in January 2021. No management fee was charged in 2020, all other fees were present. A client’s return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account, including advisory fees in the future. The performance results include the reinvestment of dividends and interest on cash balances where applicable.

All performance results are unaudited and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. All information provided is for informational purposes only and should not be deemed as advice in relation to legal, taxation, or investment matters. Past performance is not indicative of future results.

Each of the S&P 500 Index, the MSCI Index, and the Russell 2000 Index (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of an account managed by MCJ and each Index may not be comparable. There may be significant differences between an account managed by MCJ and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index. The S&P Index return was determined using the performance of Vanguard S&P 500 ETF (VOO). The MSCI Index return was determined using the performance of Vanguard Total World Stock ETF (VT). The Russell 2000 Index return was determined using the performance of Vanguard Russell 2000 ETF (VTWO).

MCJ offers investment advisory services and is registered with the state of Colorado. Registration does not constitute an endorsement of the advisory firm by the Colorado Securities Commissioner nor does it indicate that the advisory firm has attained a particular level of skill or ability. All content on this webpage is general in nature, not directed or tailored to any particular person, and is for informational purposes only. Neither this webpage nor its contents are offered as investment advice and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. In addition, neither this webpage nor its contents should be construed as legal, tax, or other advice. Individuals are urged to consult with their own tax or legal advisers before entering into any advisory contract.

The information contained herein reflects the current expectations and opinions of MCJ as of the date of publication, which are subject to change without notice at any time. MCJ does not represent that any expectation or opinion will be realized. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Neither MCJ nor any of its advisers, officers, directors, or affiliates represents that the information presented in this tear sheet is accurate, current or complete, and such information is subject to change without notice. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment.

Past performance is not indicative of future results.

Additional information is available from MCJ upon request. MCJ is not acting as your adviser or agent unless and until you and MCJ sign an investment advisory agreement.

Readers are advised that the material herein should be used solely for educational purposes. This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. MCJ Capital Partners LLC does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. MCJ Capital Partners LLC will not be liable for any loss or damage caused by a reader's reliance on information obtained in any of our newsletters, presentations, memorandums, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions.

MCJ Capital Partners and accounts actively managed by MCJ Capital Partners have long positions in RediShred Capital Corp (KUT.V) and would benefit from overall price appreciation of the stocks. At any time we may close any of these position without notice.